njtaxation.org property tax relief homestead benefit

Your benefit payment according to the Budget appropriation is calculated by. The filing deadline for the latest Homestead Benefit Application - Tax Year 2018 -.

New Jersey S Incredibly Shrinking Property Tax Relief Program

This program gives seniors 62 or older blind or disabled citizens the option of having the state pay all or part of the property taxes on their residence until the individual.

. All Property Tax Relief Benefits are Subject to Change NJ FY 2019 Budget Passed July 1 2018. Search for all public records here including property tax court other vital records. Real Tax Solutions For Real People.

Ad Save Now Save. The Homestead Exemption Program delays the payment of property taxes for single members earning less than 16000 and joint members earning less than 20000. My 2018 property taxes are late.

If you are delinquent in paying your property taxes you are still eligible to file an. Property Tax Relief Programs Property Tax Relief Programs Attention ANCHOR Applicants The deadline for filing your ANCHOR benefit application is December 30 2022. Get the Help You Need from Top Tax Relief Companies.

Ad Save Now Save. Ad We Have A Three-Phase Tax Relief Program That Shows Better Results Than Any Other Firm. You lived in New Jersey continuously since December 31 2010 or earlier as either a homeowner or renter.

Ad View all county offices info for free including hours address and phone numbers. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. See ANCHOR Program for more information or you can call 1-888-238-1233.

Property tax relief can be beneficial for those especially on limited incomes or who have been affected by wildfires or natural disasters Seniors age 55 and older or those severely disabled. Worried about high property taxes. If you filed a 2018 Homestead Benefit application and you are eligible for the same property see ID and PIN.

Can I still file for a Homestead Benefit. We can HELP call Now. Prior Year Homestead Benefit Calculations.

Often a typical homesteading advantage is that itll exempt. Worried about high property taxes. We can HELP call Now.

If a benefit has been. Homestead Benefit Status - NJ Taxation ANCHOR Benefit Online Filing Electronic Services Search here for information on the status of your homeowner benefit. If your New Jersey Gross Income is.

Generally this advantage of homesteading pertains to shielding a portion of a homes value from property taxes. Ad You Dont Have to Face the IRS Alone.

State Of Nj Department Of The Treasury Division Of Taxation

Ppt New Jersey Property Tax Relief Programs Powerpoint Presentation Free Download Id 496787

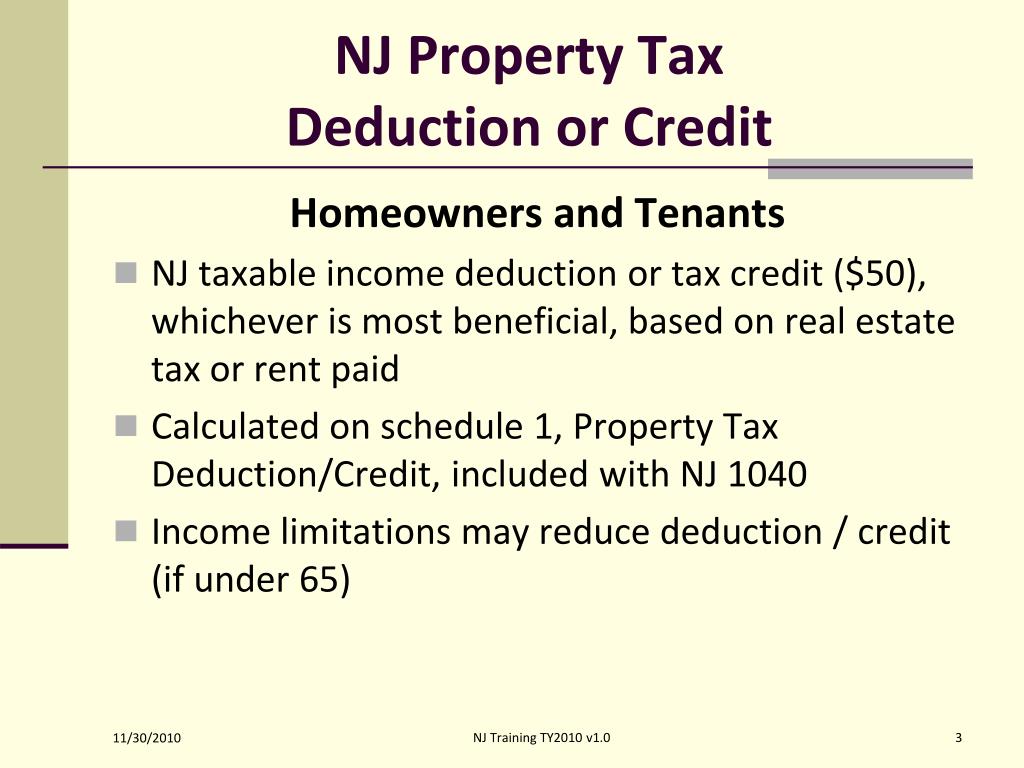

2011 Volunteer Tax Preparation Nj Division Of Taxation Ppt Download

State Of Nj Department Of The Treasury Division Of Taxation

Nj Division Of Taxation Senior Freeze Property Tax Reimbursement Program 2017 Eligibility Requirements

State Of Nj Department Of The Treasury Division Of Taxation

Nj Anchor Property Tax Relief Program Replaces Homestead Benefit Middlesex Borough

Nj Div Of Taxation Nj Taxation Twitter

Nj Division Of Taxation Contact Us

2011 Volunteer Tax Preparation Nj Division Of Taxation Ppt Download

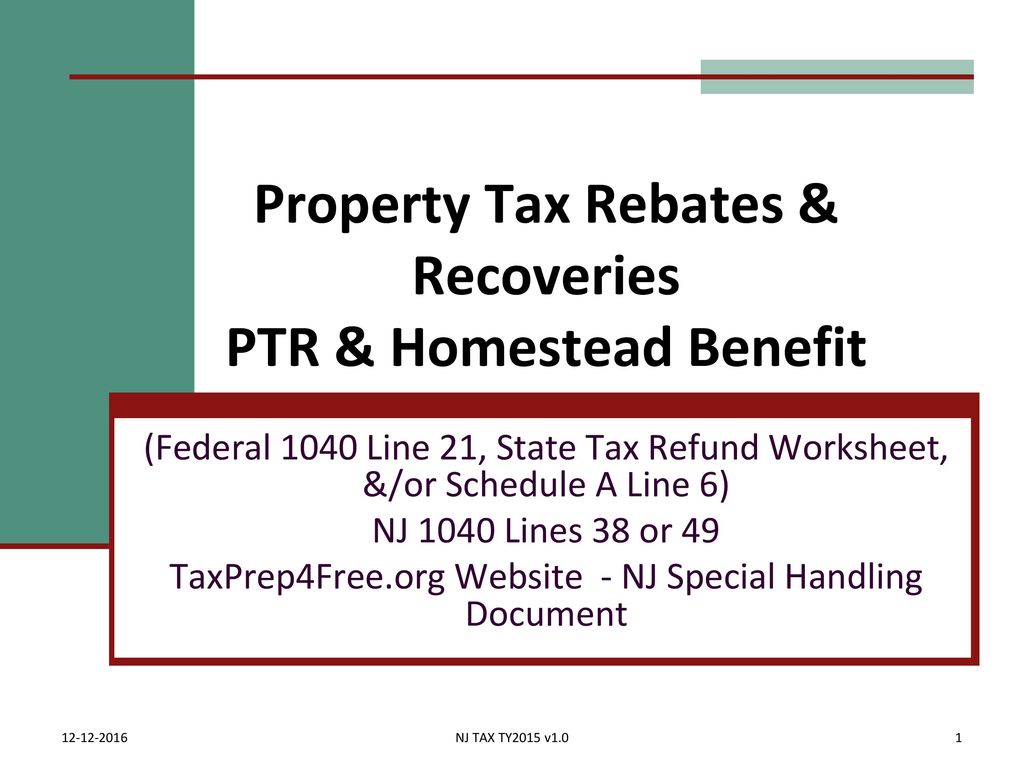

Property Tax Rebates Recoveries Ptr Homestead Benefit Federal

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Murphy Unveils Plan For Big Property Tax Rebates To Nearly 2m N J Households Nj Com

Nj Division Of Taxation Trenton Us Facebook

The Official Website Of The City Of South Amboy Nj Tax Collection

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download